An entity taxed as a flow-through will generally have greater value because of the significant tax benefits and that can be afforded the purchaser than for. The pass-through entity can be defined as a process by which any organization will be relieved from double taxation burden.

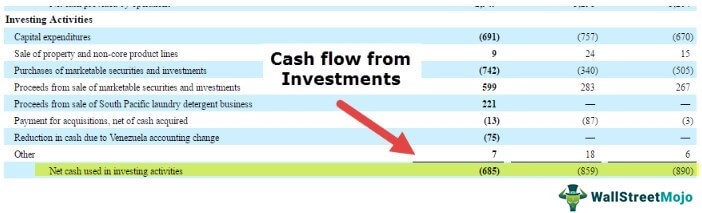

Cash Flow From Investing Activities Formula Calculations

The reason for passing through income structure is that the owners otherwise get double taxed Double Taxed.

. Blocker corporation rather than a US. Blocker to exit its investment in the US. Investors such as sovereign wealth funds to own their indirect interests in certain types of fund investments through an entity taxable as a US.

Subchapter S corporations the newer flow-through entities that many small companies organize under are effectively barred from participating in Title III equity crowdfunding because 1 the number of S corporation stockholders is limited to 100 while the number of C corporation stockholders is unlimited and 2 S corporations can issue only one. Planning devices can include the following. Real Estate Capital Markets REITs.

A summary This chapter demonstrates that careful structuring of a private equity investment is essential to minimise tax liabilities. 2 LPs and LLCs are pass-through entities for federal income tax purposes. Flow-through used to be viewed as more attractive but under certain fact patterns thats not necessarily the case anymore.

The entity passes its total income to the entitys owners and therefore taxes are calculated on the individual basis on each and every owner. They will send requests to the target company to address any outstanding issues such as visit requests calls with sales personnel non-executive management customers and suppliers. A private equity fund or other investor in purchasing a corporation may wish to establish an LLC or other pass-through entity as a holding vehicle permitting flexible economics a control vehicle and the ability to grant profits interests as a compensation incentive discussed below.

With the fast approaching state tax compliance deadlines PTEs and their owners are intensifying their attention on these taxes. Indebtedness and cannot invest in flow-through operating entities except through blocker structures as discussed below. The current prevailing trend is to have private equity funds structured to have flexibility to own both flow-through and corporate entities.

Corporation a so-called Blocker which insulates such investors from the direct obligation to pay US. It is typical in private equity funds for certain tax-sensitive investors including US. Calendar year 2021 has continued the trend of pass-through entity PTE tax proposals.

A flow-through entity is a legal business entity that passes any income it makes straight to its owners shareholders or investors. Taxation of private equity investments. Raising a private equity fund requires two groups of people.

Federal income tax purposes as either a Partnership Trust Qualified or Non-Qualified Intermediary or other non-US. Blocker corporation to hold an investment in a US. Some of the most active investors in private equity funds are governmental pension plans such as those for states or municipalities.

Through this arrangement business owners and shareholders only pay taxes on their personal income generated through this business and dont have to pay additional corporate taxes for running. A pass-through entity is a business structure in which the taxes on the generated business revenue are directly passed on to the owners to avoid double taxation. Flow-through entities are a common device used to avoid double taxation which happens with incom.

Hence the income of the entity is the same at the income of the owners or investors. Structuring Newco as Flow-Through Entity 301 NEWCO AS S CORP 34 3011 Limited Liability and General Characteristics 34 30111 General 34. As a result only these individualsand not the entity itselfare taxed on the revenues.

Investors such as sovereign wealth funds to own their indirect interests in certain types of fund investments through an entity taxable as a US. In an earlier article titled Rollover Equity Transactions 2019 we discussed the various business and tax issues associated with transactions involving private equity PE buyers who include rollovers of target owner equity in their leveraged buyout LBO transactionsHere we take a deeper dive into the ramifications of having some PE investors invest in target. Although minimum investments vary for each fund the structure of private equity funds historically follows a similar framework that includes classes of fund partners management fees investment.

Tax exempts and non-US. Flow-through portfolio company as the court decision may permit the non-US. PTEs and their owners should take these taxes into account when determining the impacts at the entity and owner levels.

1057 Formation of Private Equity Venture Capital or Buyout Fund 113 106 HISTORY OF PRIVATE EQUITYVENTURE CAPITAL INVESTING 113. The team of individuals that will identify execute and manage investments in privately-held operating businesses. A flow-through entity is a business entity is which income of the entity passes on to the investors or owners of the entity.

A purchaser will still obtain a basis step-up in the context of the purchase of 100 of the entity equity interests. Flow-Through Entities If your institution is organized outside the US and is classified for US. Corporation a so-called Blocker which insulates such investors from the direct obligation to pay US.

In this stage of the private equity investment process flow chart the deal team typically interacts with the investment bank and the management of the target company on a daily basis. 1 Financial Sponsor Sponsor in image. Tax reform has resurrected the debate about which structure is better today.

Tax exempts and non-US. Deloitte specialists in flow-through and partnership tax compliance can help you understand and evaluate the tax-rate reductions incentives and thresholds applicable to your current business and compare whether a flow-through partnership or S corporation S corp structure is still the right approach to meeting your business goals. This is because a US tax-exempt entity is deemed to carry on the unrelated business of any flow-through entity in which it has invested.

Most governmental plans take the position that as governmental entities. This is generally comprised of a General. It is typical in private equity funds for certain tax-sensitive investors including US.

Branches for United States. Flow-through entity an original Form W-8IMY Certificate of Foreign Intermediary Foreign Flow-Through Entity or Certain US. In this legal entity income flows through to the owners of the entity or investors as the case may be.

Flow-Through Entities Based on this Tax Court decision private equity funds are likely to consider using a non-US.

4 Types Of Business Structures And Their Tax Implications Netsuite

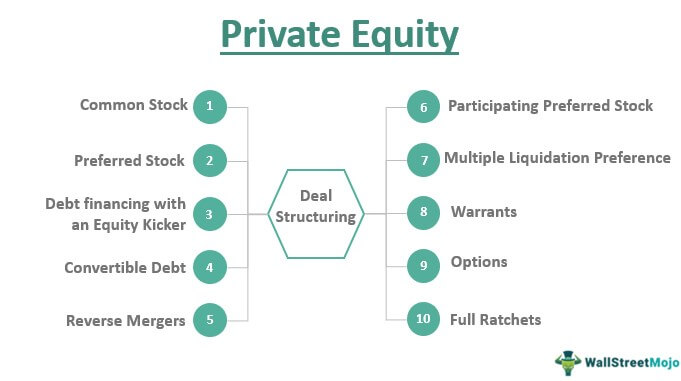

Private Equity Meaning Investments Structure Explanation

Carried Interest Guide For Private Equity Professionals

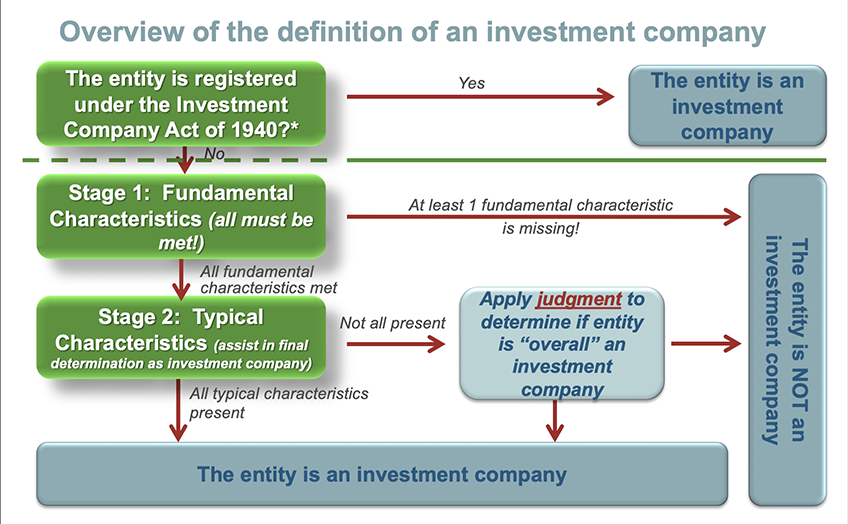

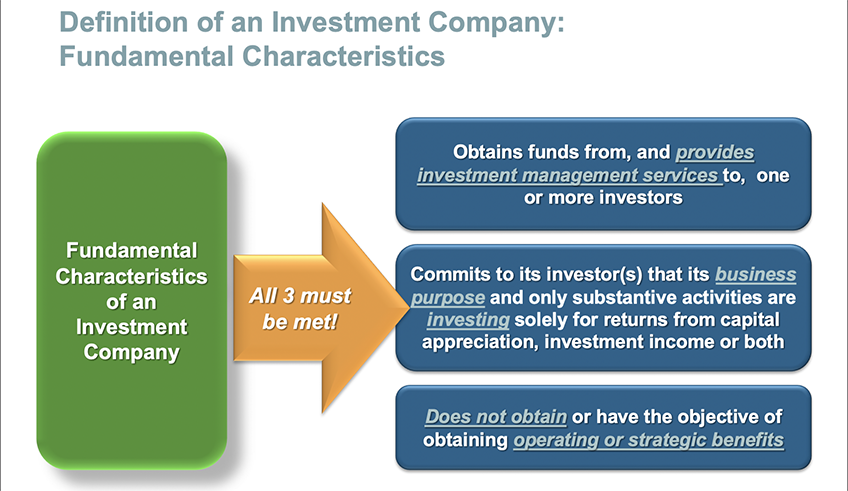

Accounting For Investment Companies Under Asc 946 An Overview Gaap Dynamics

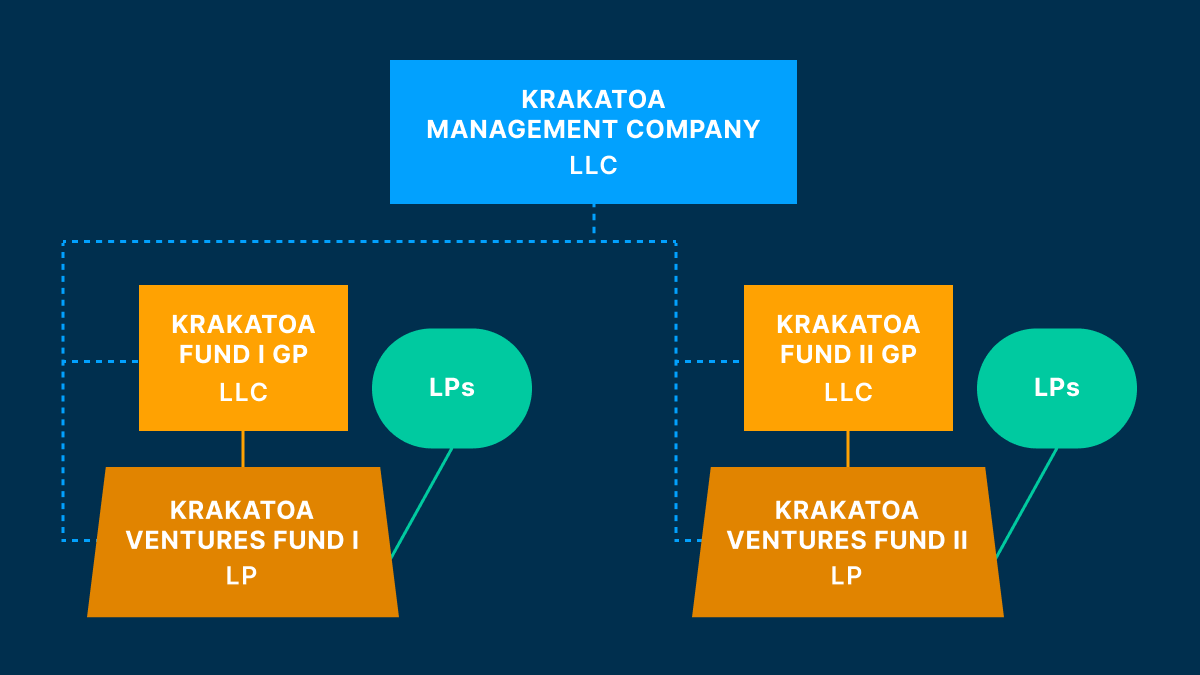

Private Equity Fund Structure A Simple Model

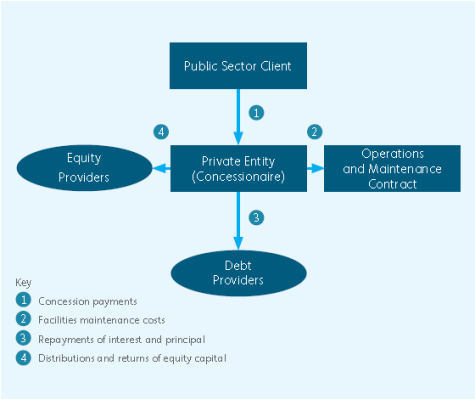

What Are Public Private Partnerships

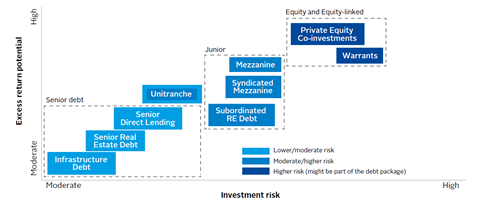

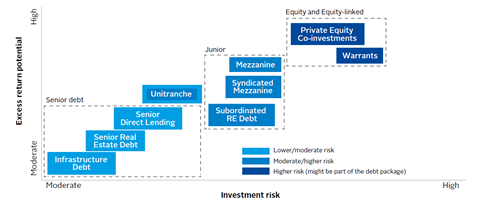

An Overview Of Private Debt Technical Guide Pri

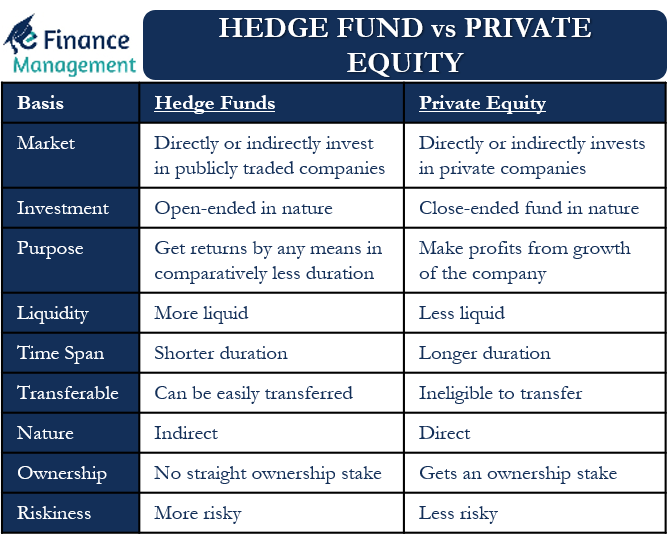

Hedge Fund Vs Private Equity Meaning Differences And More Efm

What Is Private Equity Deal Structure Flow Process Guide

Pass Through Entity Definition Examples Advantages Disadvantages

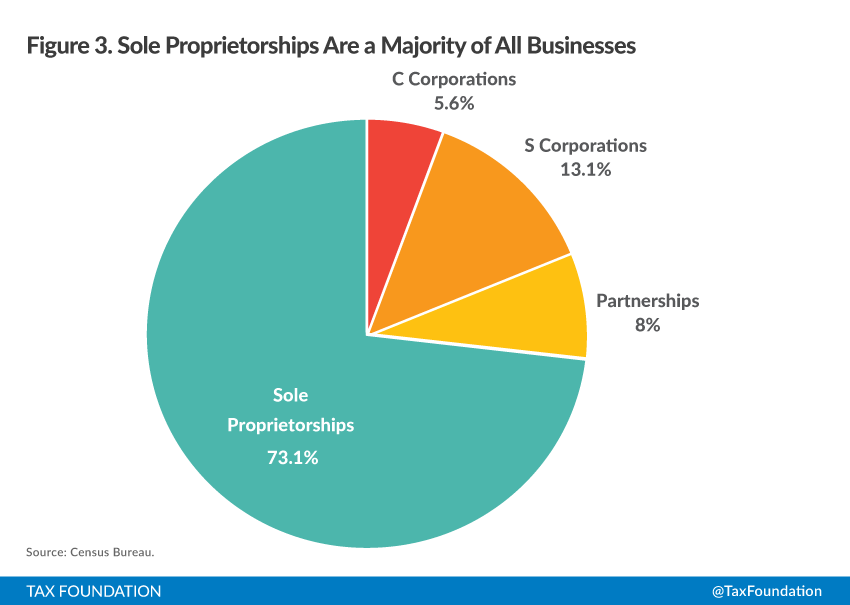

An Overview Of Pass Through Businesses In The United States Tax Foundation

Free Cash Flow To Firm Fcff Formulas Definition Example

Pass Through Entity Definition Examples Advantages Disadvantages

What Is A Private Equity Waterfall The Preferred Method Of Equity Funding

Private Equity An Overview Sciencedirect Topics

Accounting For Investment Companies Under Asc 946 An Overview Gaap Dynamics

The Legal Structures Of Venture Capital Funds Carta