You can change your settings at any time. CSOP iEdge S-REIT Leaders Index ETF Photo.

S Reit Report Card Here S How Singapore Reits Performed In Fy2018

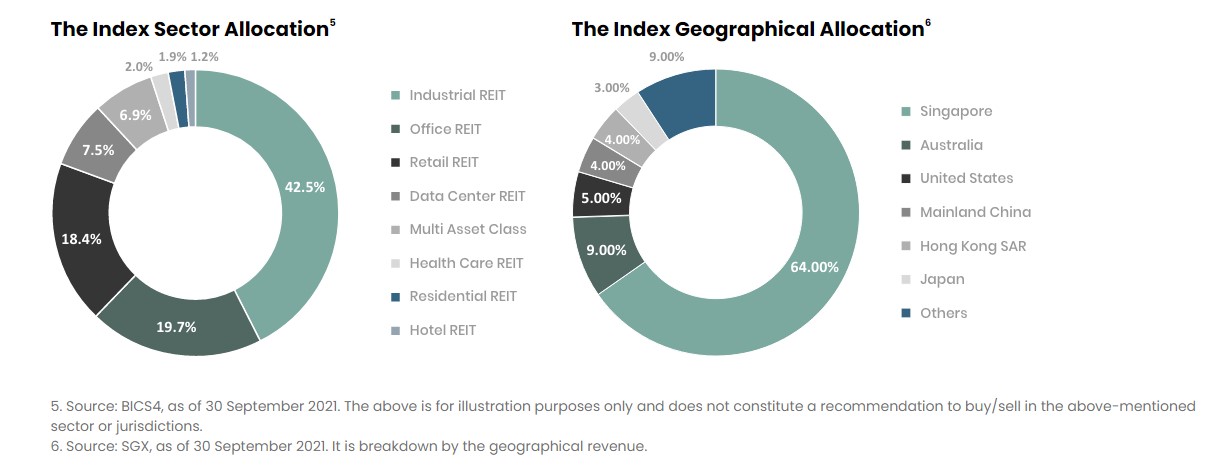

The Index consists of 28 S-REITs one more than the Morningstar Singapore REIT Yield Focus Index which is tracked by the Lion-Phillip S-REIT ETF SGX.

. CSOP Asset Management will list its second Exchange-Traded Fund ETF on SGX - CSOP iEdge S-REIT Leaders Index ETF Stock Code. Launched in 2014 the iEdge S-REIT Leaders Index is an index established to measure the performance of the largest and most liquid REITs listed in the Singapore Stock Exchange SGX. Proxied by iEdge S-REIT Leaders SGD Index Total Return 4 Source.

To ensure that the REITs tracked by the index are the most liquid REITs the iEdge S-REIT Leaders Index employs a liquidity-adjustment strategy. Online subscription for the ETF is now open during the Initial Offer Period IOP online from 29 October 2021 till 15 November 2021 by 930am. Bloomberg SGX as end of 2020 2 Source.

To learn more about how we collect and use cookies and how you configure. It is a market capitalisation weighted index that tracks the performance of the most liquid REITs in Singapore. A real estate investment trust in Singapore S-REIT is a fund on SGX that invests in a portfolio of income generating real estate assets such as shopping malls offices or hotels usually with a view to generating income for unit holders of the fund.

If you click Accept Cookies or continue without changing your settings you consent to their use. The FTSE EPRA Nareit Developed Index declined 18 per cent in the YTD. GIFT AN ARTICLE.

Bloomberg CSOP 6 May. Growth Track is SGX Groups podcast series where we focus on investment and growth opportunities across Asia. Tune in to Growth Track Podcast.

GIFT AN ARTICLE. Michael Syn head of equities at SGX said the CSOP iEDGE S-REIT Leaders Index ETF added to the exchanges. The latest 12-month dividend yield is at 408 as of 31 October 2021.

The iEdge S-REIT Leaders Index isnt new in fact it has been around since 2014. If we assume dividends are not reinvested the returns would have been 431. By investing in this index you get instant diversification across all the various S-REITs.

The latest 12-month dividend yield is at 408 as of 31 October 2021. The iEdge S-REIT Leaders Index is an adjusted free-float market-capitalization weighted index tracking the performance of Singapores largest and most-tradeable REITs according to the index factsheet. The CSOP iEdge S-REIT Leaders Index ETF is a Sub-Fund of the CSOP SG ETF Series I Unit Trust.

Business Wire A real estate investment trust in Singapore S-REIT is a fund on SGX that invests in a portfolio of income generating real estate. If we assume dividends are not reinvested the returns would have been 431. CSOP IEDGE S-REIT LEADERS INDEX ETF - SGD.

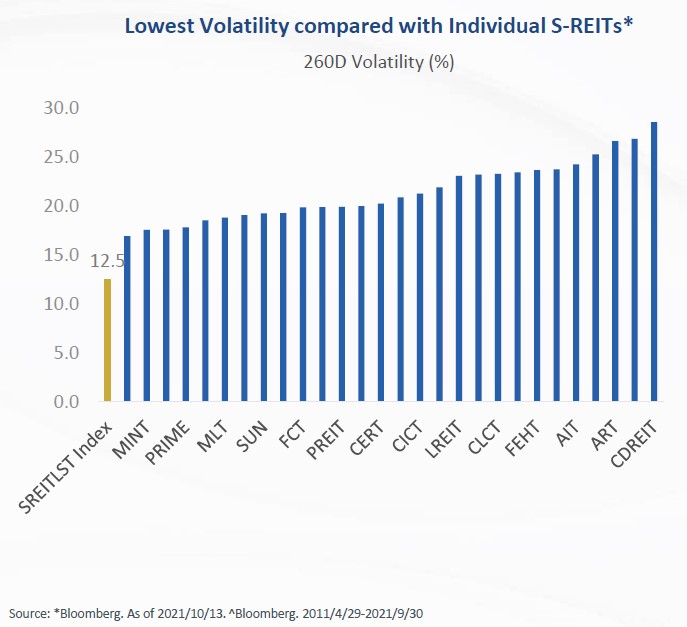

The ETF has several unique characteristics which stand out in particular. In terms of sustainability of its yield from my understanding the iedge s-reit leaders index is projected to deliver a growth of 593 and a yield of 543 in 2022 according to bloomberg terminal as at 30 september 2021 and highlighted in rectangular boxes below and as the csop iedge s-reit leaders etf tracks the performance of this index. Find the latest information on iEdge REIT REITSI including data charts related news and more from Yahoo Finance.

Get CSOP iEdge S-REIT Leaders Index ETF CSOP-SGSingapore Exchange real-time stock quotes news price and financial information from CNBC. The index has 28 constituents. Based on historical data we can see that its total return of the iEdge S-REIT Leaders Index over the past 5 years is at 950 inclusive of dividends being reinvested.

The Sub-Fund is a passively managed index-tracking ETF with an investment objective of replicating closely the performance of the iEdge S-REIT Leaders Index the Index. Based on historical data we can see that its total return of the iEdge S-REIT Leaders Index over the past 5 years is at 950 inclusive of dividends being reinvested. Thank you for registering.

Banks technology and Reits have now booked the most net institutional outflows across the sectors in 2022 YTD. IEdge S-REIT Index - Singapore Exchange SGX We use cookies to ensure that we give you the best experience on our website. SGX as of 30 September 2021.

A real estate investment trust in Singapore S-REIT is a fund on SGX that invests in a portfolio of income generating real estate assets such. Refers to dividend yield of iEdge S-REIT Leaders Index. In the YTD STIs total returns have maintained at 1 per cent and iEdge S-Reit Index has declined 08 per cent.

Already have an account. Kurs Charts Kurse Empfehlungen Fundamentaldaten Echtzeitnews und Analysen CSOP IEDGE S-REIT LEADERS INDEX ETF - SGD SGXC35358685 Singapore Stock Exchange. Rather than picking just one or two REITs to invest in we can invest in the entire index with the same amount of capital instead.

Bloomberg 14 October 2011 15 October 2021. SGX as of 30 June 2021 6 Source. With the soon to be listed CSOP iEdge S-REIT Leaders Index ETF investors will now be able to invest in S-REITs via an ETF to reap its diversification benefits.

The ETF aims to replicate the iEdge S-REIT Leaders Index as closely as possible. This index aims to measure the performance of the largest and most traded REITs on the SGX. The iEdge S-REIT Leaders Index ETF is a diversified and return-focused ETF that provides investors with exposure to some of the most important uprising industriesin real estate in different geographical locations with Singaporebeing the.

Get detailed information on iEdge S-REIT Index REITSI including stock quotes financial news historical charts company background company fundamentals company financials insider trades annual reports and historical prices in the Company Factsheet. For example the iEdge S-REIT Leaders Index is constructed to reflect the performance of the largest REITs in Singapore. IEdge S-REIT Leaders Index USD - Singapore Exchange SGX Loading.

GIFT AN ARTICLE. Constituents of the iEdge S-Reit Index SIGN UP FOR FREE. You have unlocked this premium article.

Please verify your email to read this premium article in full. It has delivered an annualised return of 992 in the past 5 years and a dividend yield last 12 months of 396. SGX as of 30 September 2021 5 Source.

Top 5 S Reits Property Trusts Averaged 14 1 Total Returns In 1q22 Traders Insight

4 Things About The Csop Iedge S Reit Leaders Index Etf Srt Sru To Know Before Investing

Csop Iedge S Reit Leaders Index Etf To List On Sgx

Constituents Of The Iedge S Reit Index Companies Markets The Business Times

Csop Iedge S Reit Leaders Index Etf Invest In This Etf For Stable Dividend Yield No Money Lah

4 Things About The Csop Iedge S Reit Leaders Index Etf Srt Sru To Know Before Investing

Csop Iedge S Reit Leaders Index Etf What Investors Should Know About This New Reit Etf

Csop Iedge S Reit Leaders Index Etf What Investors Should Know About This New Reit Etf

Why Singapore Reit Investors Should Consider Investing Via The Iedge S Reit Leaders Index

Syfe Reit Vs Csop Iedge S Reit Leaders Index Etf Which Reit Investment Should You Choose

Singapore Reit Etfs Guide Comprehensive

Csop Iedge S Reit Leaders Index Etf Invest In This Etf For Stable Dividend Yield No Money Lah

Index Update Sgx S Iedge S Reit 20 Index Will Become The Iedge S Reit Leaders Index

Csop Iedge S Reits Leaders Index Etf Riding The Wave With S Reits Leaders Youtube

Does Inflation And Rising Interest Rate Affect Reits Featuring Csop Iedge S Reit Leaders Index Etf Edition

Csop Iedge S Reit Leaders Index Etf Poems

Index Update Sgx S Iedge S Reit 20 Index Will Become The Iedge S Reit Leaders Index

Reits Report Card 2021 How Singapore Reits Performed In 2nd Quarter 2021

Csop Iedge S Reit Leaders Index Etf Invest In This Etf For Stable Dividend Yield No Money Lah